JProf. Dr. Antonia Arsova

Kontakt

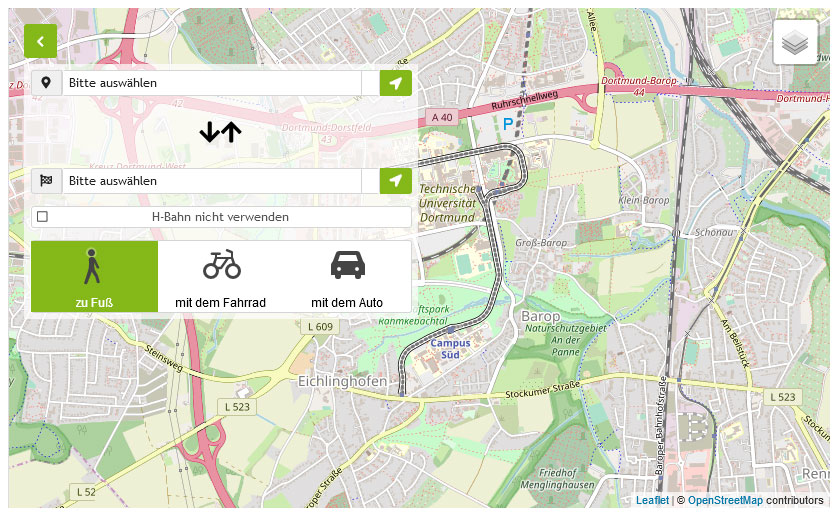

Technische Universität Dortmund

Fakultät Statistik

Fachgebiet Ökonometrie

CDI-Gebäude, Raum 6

44221 Dortmund

E-Mail: arsova@statistik.tu-dortmund.de

Tel.: +49 231 755 5419

- seit Oktober 2019: Juniorprofessorin für Ökonometrie, Technische Universität Dortmund

- 2012-2019: Promotion in Ökonometrie zum Dr. rer. pol, Leuphana Universität Lüneburg

- 2012-2018: Wissenschaftliche Mitarbeiterin am DFG-Projekt "Likelihood-Basierte Panelkointegrationsmethodik und Ihre Anwendungen in Makroökonomik und Finanzmaktanalyse", Leuphana Universität Lüneburg

- 2009-2012: Kreditrisiko-Analystin, Experian Decision Analytics

- 2008-2011: M.Sc. in Wahrscheinlichkeitstheorie und Statistik, Sofioter Universität "St. Kliment Ohridski"

- 2004-2008: B.Sc. in Angewandte Mathematik, Sofioter Universität "St. Kliment Ohridski"

- Räumlich-Zeitliche Analyse

- Nichtstationäre Zeitreihen und Paneldaten

- Querschnittsabhängigkeit in Paneldaten

- Kointegration

- Empirische Makroökonometrie

Projektleiterin von Teilprojekt C02: "Renewable energy forecasts and their impact on electricity prices" im DFG TRR 391 "Spatio-temporal Statistics for the Transition of Energy and Transport".

- Berrisch, J., Pappert, S., Ziel, F. und Arsova, A. (2022). Modeling volatility and dependence of European carbon and energy prices. Finance Research Letters 52, 103503. DOI.

- Pappert, S., und Arsova, A. (2022). Forecasting Natural Gas Prices with Spatio-Temporal Copula-Based Time Series Models. In International Conference on Time Series and Forecasting (pp. 221-236). Cham: Springer Nature Switzerland. DOI.

- Arsova, A. (2021). Exchange rate pass-through to import prices in Europe: a panel cointegration approach. Empirical Economics 61, 61-100. DOI.

- Arsova, A. und Karaman Örsal, D. D. (2020). A panel cointegrating rank test with structural breaks and cross-sectional dependence. Econometrics and Statistics 17, 107-129. DOI.

- Arsova, A. und Karaman Örsal, D. D. (2020). Intersection tests for the cointegrating rank in dependent panel data. Communications in Statistics - Simulation and Computation 49, 918-941. DOI.

- Arsova, A. und Karaman Örsal, D. D. (2018). Likelihood-based panel cointegration test in the presence of a linear time trend and cross-sectional dependence. Econometric Reviews 37, 1033-1050. DOI.

- Karaman Örsal, D. D. und Arsova, A. (2017). Meta-analytic cointegrating rank tests for dependent panels. Econometrics and Statistics 2, 61-72. DOI.

- Arsova, A. (2019). Exchange rate pass-through to import prices in Europe: A panel cointegration approach. Working Paper 384, Working Paper Series in Economics, Leuphana Universität Lüneburg. Link.

- Arsova, A. und Karaman Örsal, D. D. (2016). A panel cointegration rank test with structural breaks and cross-sectional dependence. In Jahrestagung des Vereins für Socialpolitik 2016: Demographischer Wandel: Session: Time Series Econometrics, No. D01-V3, Deutsche Zentralbibliothek für Wirtschaftswissenschaften (ZBW). Link.

- Arsova A. und Karaman Örsal D. D. (2016). An intersection test for the cointegrating rank in dependent panel data. Working Paper 357, Working Paper Series in Economics, Leuphana Universität Lüneburg. Link.

- Karaman Örsal, D. D. und Arsova A. (2015). Meta-analytic cointegrating rank tests for dependent panels. Working Paper 349, Working Paper Series in Economics, Leuphana Universität Lüneburg. Link.

- Arsova, A. und Karaman Örsal, D. D. (2013). Likelihood-based panel cointegration test in the presence of a linear time trend and cross-sectional dependence. Working Paper 280, Working Paper Series in Economics, Leuphana Universität Lüneburg. Link.

- Econometric Forecasting (with Matei Demetrescu) (WiSe 2025/26)

- Econometrics (SoSe 2025)

- Unit Root and Cointegration Analysis (WiSe 2024/25)

- Time Series Analysis (SoSe 2024)

- Unit Root and Cointegration Analysis (SoSe 2023)

- Time Series Analysis (SoSe 2022)

- Introductory Case Studies (WiSe 2020/21)

- Econometrics (SoSe 2020)

- Zeitreihenanalyse (A. Arsova, R. Schüssler) (WiSe 2019/20)

- Predicting Wind Power: A Probabilistic Forecasting Approach with Generalised Additive Models for Location, Scale and Shape (MSc Econometrics, 2025)

- Implementing Continuous Distributions in the Rolch Package in Python (MSc Data Science, 2025)

- Unsupervised temperature sensor anomaly detection for fault diagnosis in heating appliances (MSc Data Science, 2024)

- Reject Inference mit Semi-Supervised Clustering – Eine empirische Fallstudie mit einer deutschen Bank (MSc Statistik, 2024)

- Comparison of short-term probabilistic and pointwise electric vehicle load forecasting at electric charging stations in Denmark using a deep learning approach (MSc Data Science, 2024)

- Volatilitätsmodellierung und Prognose des kurzfristigen Zinses: Eine statistische Analyse (BSc Statistik, 2023)

- The Gaussian copula assumption of the inverse normal method for dependent cointegration test statistics (BSc Statistik, 2021)